This post is sponsored by Poppins Payroll

So you’ve found the perfect nanny. She’s bilingual, CPR certified, and she got your kid on a solid nap schedule. You feel at ease leaving your little one each day with such a sweet and responsible caregiver. But are you paying her the proper and legal way? Let’s talk about the nanny taxes and how to get them right!

Your nanny is your employee. As a person that you hire to work in your home, she’s legally considered an employee, not a contractor. As an employer, you are legally required to withhold taxes from her pay.

This so-called “nanny tax” means you’ll need to keep track of payroll, calculating tax withholdings, and filing taxes, among other things. It can get overwhelming, which is why I recommend you hire a professional service to make sure it’s done right.

Poppins Payroll specializes in payroll and bookkeeping for in-home employees. That includes nannies, housekeepers, and senior caregivers, or anyone else working in your home. Most standard payroll services aren’t as familiar with the unique aspects of these types of taxes, so I can’t emphasize enough how much of a difference it makes to use a service with this specific expertise.

Poppins Payroll specializes in payroll and bookkeeping for in-home employees. That includes nannies, housekeepers, and senior caregivers, or anyone else working in your home. Most standard payroll services aren’t as familiar with the unique aspects of these types of taxes, so I can’t emphasize enough how much of a difference it makes to use a service with this specific expertise.

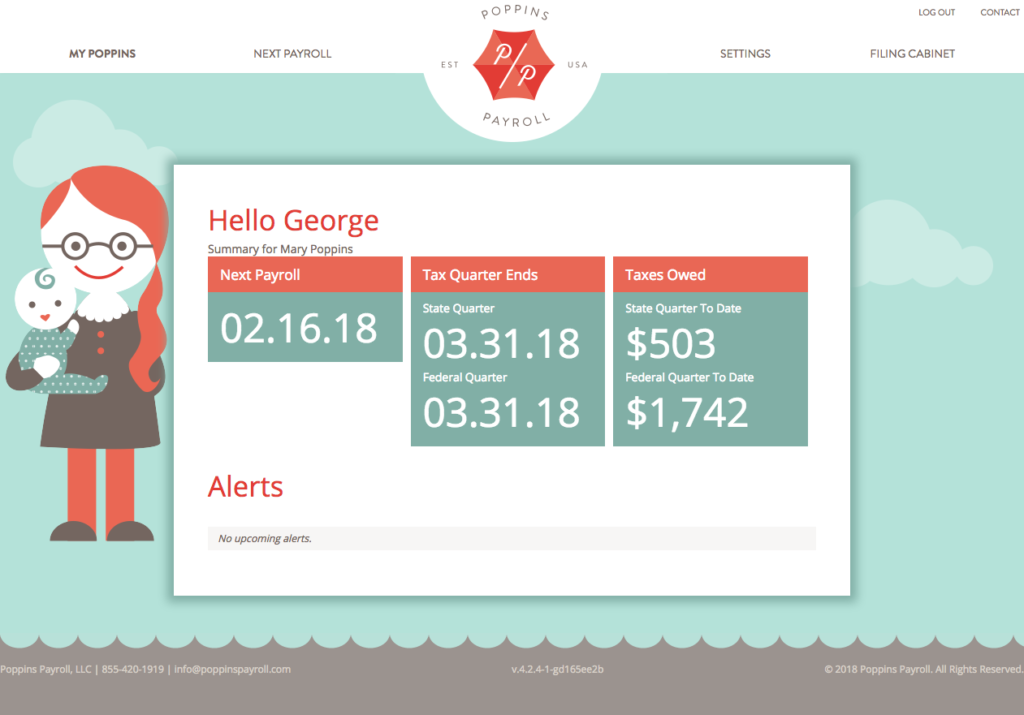

My favorite part about Poppins Payroll is how simple it is to sign up and use the service. The whole process is streamlined: You just sign up with your basic information (which is saved so you’re not re-entering anything), and they set everything up for you. They even get you your tax ID!

Poppins Payroll calculates all the withholdings for you and keeps track of your bookkeeping paperlessly. In fact, it’s all paperless, and all you need to do is e-sign when your signature is needed. Your records are saved securely so there’s no need to cram another file folder with forms.

Poppins Payroll calculates all the withholdings for you and keeps track of your bookkeeping paperlessly. In fact, it’s all paperless, and all you need to do is e-sign when your signature is needed. Your records are saved securely so there’s no need to cram another file folder with forms.

I love how once you set up your account, you can all but forget about your nanny’s payroll. But, if ever a question or concern does arise, Poppins Payroll’s customer service is top notch. They reply quickly and professionally, and their level of courtesy is quite refreshing.

They’re also super affordable, at just $39 per month. This price is straightforward and includes all services; no hidden fees! Get started with Poppins Payroll here!